Voya Financial Transforms Retirement Plan Enrollment Process with New Online Experience

Participant website enhanced with retirement savings planning features that address healthcare costs and Social Security -- two of the biggest concerns affecting retirement readiness

Jul 28, 2015

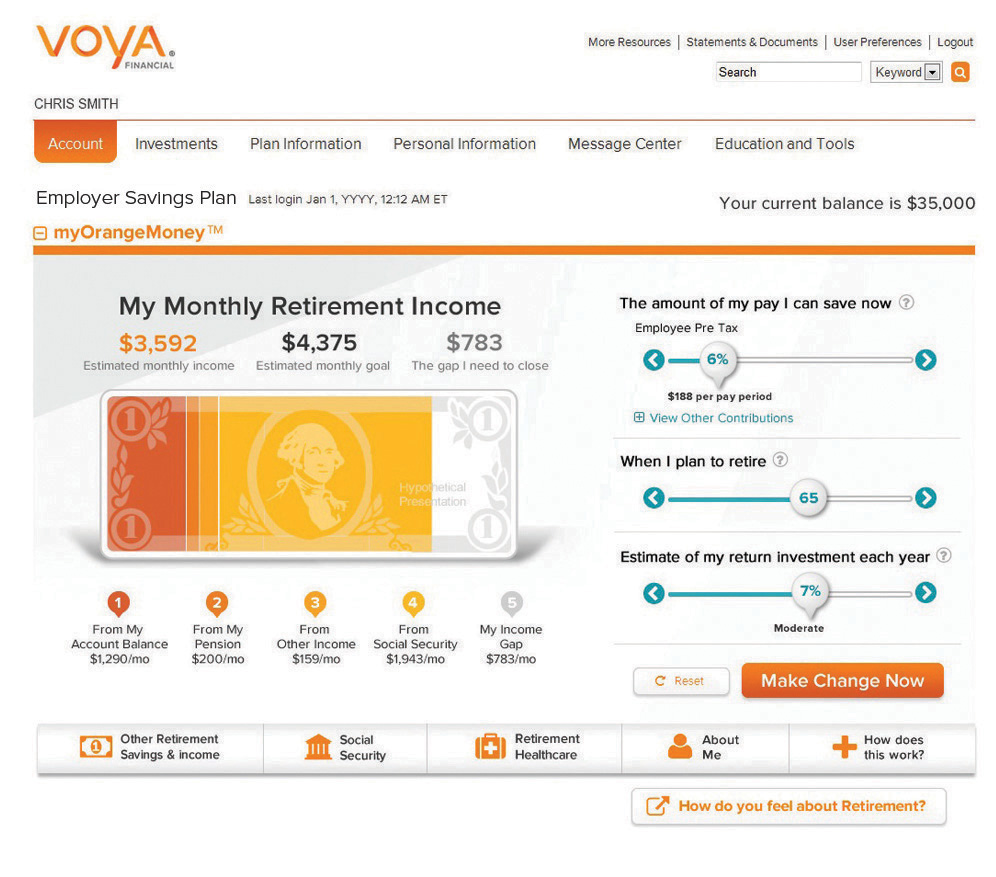

WINDSOR, Conn., July 28, 2015 /PRNewswire/ -- Voya Financial, Inc. (NYSE: VOYA), announced today that many of its retirement plan customers will soon be able to enroll in their employer-sponsored plan in a more meaningful way. As a result of enhancements to the company's suite of digital retirement readiness capabilities, participants in many of Voya-administered plans will be able to visualize and understand — as soon as they enroll online in the plan — how their savings decisions translate into future monthly retirement income. Innovative features that leverage Voya's award-winning1 myOrangeMoney participant website platform will allow enrollees to optimize their employer's company match and also benchmark themselves to peers who are saving for a secure retirement. In addition, existing participants will benefit from new functionality that lets them factor Social Security and healthcare costs into their retirement planning decisions. An infographic illustrating the need for these types of retirement planning capabilities is available at http://go.voya.com/Infographic.

Experience the interactive Multimedia News Release here: http://www.multivu.com/players/English/7446752-voya-financial-enhanced-online-enrollment/

"Voya Financial is committed to helping Americans plan, invest and protect their savings so they can get ready to retire better, and this includes the critical point at which they first enroll in their workplace savings plan," said Charlie Nelson, CEO of Retirement at Voya Financial. "Participants must make a number of key decisions when they join a plan — such as how much to contribute each pay period and what they need to save to meet their future monthly income goals in retirement. In order to make plan enrollment a more informed and effortless process, we've revolutionized the experience by connecting enrollment to the broader concept of retirement income goals. We've also added in unique features that let customers easily see and elect a contribution rate that gets them to their full company match, or which aligns to their peers who are potentially on track for a secure retirement."

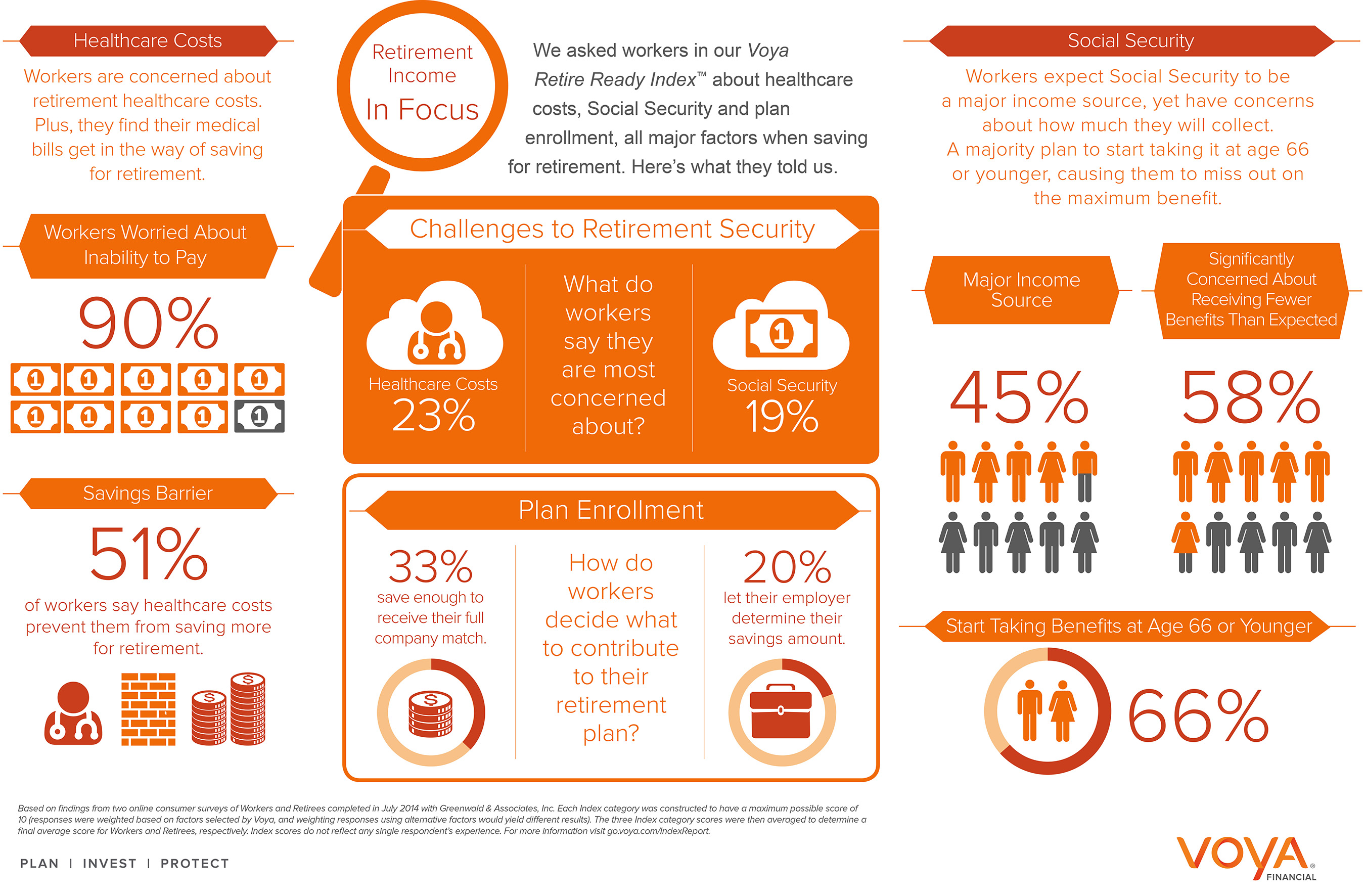

Findings from the Voya Retire Ready Index2 show the various ways that individuals go about making contribution decisions during enrollment. According to the study, of those workers who were participating in an employer-sponsored retirement plan, one-third (33%) chose to save up to the amount their employer would match. One-in-five (20%) saved an amount that was determined automatically by their employer, while a slightly smaller group (17%) contributed up to the maximum amount allowed by the plan. Nearly one-in-three (29%) said they used "some other method" to determine their contribution rate.

Voya's new digital experience offers a consistent, guided framework with a few simple questions to facilitate the enrollment process. Using the visual imagery of Voya's myOrangeMoney digital platform, customers get a snapshot of their retirement readiness illustrated on an image of a large dollar bill. The more the dollar bill is shaded orange, the more they are on target to meet their potential monthly income needs in retirement. This additional context helps individuals better understand how the savings decisions they make today can translate to outcomes in the future, enabling them to take action and plan for retirement with confidence. The responsive design of myOrangeMoney will make the enrollment experience even more convenient by allowing individuals to enroll from their phone, tablet or computer — anywhere, anytime.

Healthcare and Social Security; Top of Mind for Americans

In addition to enhancing the enrollment experience, existing plan customers who log into their account will also have access to a new Retirement Healthcare Planner and Social Security Illustrator added to Voya's myOrangeMoney platform.

"As we grow older, unexpected healthcare expenses can put a significant stress on our retirement finances. At the same time, determining when to collect Social Security can add to the complexity of retirement planning," said Nelson. "Adding healthcare and Social Security planning functions to myOrangeMoney now gives our customers an even more holistic picture to help them prepare."

The Voya Retire Ready Index reinforces how a greater understanding of healthcare costs and Social Security benefits can play a big part in achieving retirement security. The study found that more than six-in-ten (61%) workers were significantly concerned about their inability to pay for healthcare expenses in retirement. A majority (58%) were also significantly concerned that they would end up with fewer Social Security benefits than expected, yet almost half (45%) planned to rely on Social Security as a major source of their income in retirement. Adding to the challenge — two-thirds (66%) of workers planned to start taking Social Security at age 66 or younger — possibly missing out on the opportunity to collect their maximum benefit.

Voya's new Social Security Illustrator allows users to model different combinations of their anticipated retirement age and the age when they want to start receiving benefits. The Retirement Healthcare Planner shows them how healthcare costs may increase with age and how this may affect monthly retirement income needs. Customers have the option to turn these features "on" and "off" when modeling various scenarios. They also have the ability to download or update the Voya Retirement mobile app to access the myOrangeMoney experience. The new enrollment, Social Security and healthcare features will be accessible on mobile devices later this year.

A video highlighting these new resources is available at http://go.voya.com/myOrangeMoneyEvolution. They are the latest in a suite of digital capabilities that underscore Voya's focus on supporting customers through innovation and technology. As an industry leader and advocate for greater retirement readiness, Voya is committed to delivering on its vision to be America's Retirement Company™ and its mission to make a secure financial future possible — one person, one family, one institution at a time.

|

Media Contacts: |

|

|

Joe Loparco |

Bill Sutton |

|

Voya Financial |

Voya Financial |

|

Office: (860) 580-2677 |

Office: (860) 580-2626 |

|

Cell: (860) 462-6525 |

Cell: (315) 373-9685 |

1) Voya Financial's myOrangeMoney™ platform received an Insured Retirement Institute (IRI) Marketing Innovation Award, March 2015. Voya also earned a DALBAR 2014 Communications Seal representing excellence in financial services communications for its participant website, which features myOrangeMoney.

2) The Voya Retire Ready Index™ study (published March 30, 2015) measures the retirement readiness levels of Americans who are working and recently retired. The results are based on findings from two online consumer surveys completed between July 14 and July 25, 2014 with Greenwald & Associates, Inc., a full-service market research firm. Additional findings from the Voya Retire Ready Index™ study are available at http://go.voya.com/IndexReport.

About Voya Financial®

Voya Financial, Inc. (NYSE: VOYA), helps Americans plan, invest and protect their savings — to get ready to retire better. Serving the financial needs of approximately 13 million individual and institutional customers in the United States, Voya is a Fortune 500 company that had $11 billion in revenue in 2014. The company had $486 billion in total assets under management and administration as of March 31, 2015. With a clear mission to make a secure financial future possible — one person, one family, one institution at a time — Voya's vision is to be America's Retirement Company™. The company is equally committed to conducting business in a way that is socially, environmentally, economically and ethically responsible — Voya has been recognized as one of the World's Most Ethical Companies, by the Ethisphere Institute, and as one of the Top Green Companies in the U.S., by Newsweek magazine. For more information, visit voya.com or view the company's 2014 annual report. Follow Voya Financial on Facebook and Twitter @Voya.

SOURCE Voya Financial, Inc.